States Can Opt Out of the Costly and Ineffective “Domestic Production Deduction” Corporate Tax Break | Center on Budget and Policy Priorities

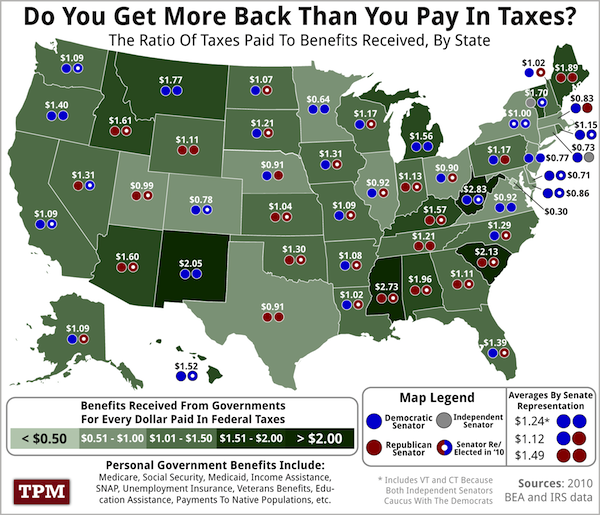

Study: Washington is one of 10 states that send more tax dollars to D.C. than they receive in federal spending - Opportunity Washington

/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)